Disclosure: I am part of the RBC RESP blogger program with Mom Central Canada and I receive special perks as part of my affiliation with this group. The opinions on this blog are my own.

When I was a little girl, I wanted to be a veterinarian.

I know. Didn’t every little girl want to be a vet? That, or a marine biologist. I think it’s a rite of passage, or something, to want to help animals when you’re deciding your career path.

I was dead serious about being a vet, though. We lived on a hobby farm with the gang from a James Herriot novel.

When my fool of a horse broke into the pig feed – and I had to walk him around the field, praying that he didn’t colic and keel over – I had a realization: “I”m meant to be a vet… look at me! Walking this idiot horse around at 9 at night, just so his insides don’t twist into a knot and kill him! I’m so compassionate and understanding of animals!”

And then I did some job shadowing at a local animal hospital. During the routine spaying of a German Shepherd, my head got light and my stomach dropped. The floor spun. I sunk to the floor in the middle of the surgery.

I had nearly passed out at the sight of ovaries being plucked from their cozy little home. This is pretty common in the Dog and Cat World, from what I understand. Bob Barker wants you to get these bad boys taken out!

Within a month, I was sitting with the counsellor at school, looking at English Literature courses.

But one thing that didn’t cross my mind during my ever-shifting career aspirations was how I was going to afford the necessary schooling. I was lucky; my parents had an education fund saved up for me, and I would be able to attend the program and the school of my choosing without facing a financial burden.

It was a gift. A gift with a value that I didn’t quite understand until I became an adult with my own two little ones.

Some people say, “I want to give my kids more than what I had.” I don’t. I just want to give Lila and Lucy the same opportunities that I was given. And it requires a bit of planning.

First day of school for Miss Lila. She was so tickled to be going back to preschool.

First day of school for Miss Lila. She was so tickled to be going back to preschool.

Because Mr. Suburble and I both had our post-secondary educations paid for by our families, we were able to toss our caps, grab our diplomas and head into the Big Scary World without a certain monkey on our backs: a student loan.

And we are both so grateful that we were able to focus on moving ahead, instead of paying for something that was behind us.

Now that we have two future veterinarians/accountants/electricians/artists living under our roof, we’re planning to cover the bill for their post-secondary educations. We sock away a bit of money into an RESP (Registered Education Savings Plan) every month, with the plan that when they choose their paths, there will be some money put aside to help them on their way.

They will be able to select the programs that they want to take, without the worry of mounting costs or huge loans.

Lucy’s first day of preschool – ever. I love her giant backpack. And so does she. She insists on carrying it to class all by herself.

Lucy’s first day of preschool – ever. I love her giant backpack. And so does she. She insists on carrying it to class all by herself.

I think that saving for something like post-secondary education can be daunting. Huge numbers – tens of thousands of dollars – get thrown around in conversation. And how can anyone save that much money? Where to even begin?

It’s about starting with what you can afford and staying consistent. Royal Bank has the RESP-matic, where funds are automatically taken from your account every month, so that the funds grow without you having to consciously move them over. It’s a great way to “force” savings.

What’s more, is that in Canada, there is money available from the government for your child’s education fund. With the Canada Education Savings Grant, you can earn 20% of your $2,500 annual contribution. This means a grant of up to $500 a year – with a maximum of $7,200 per child – towards their education.

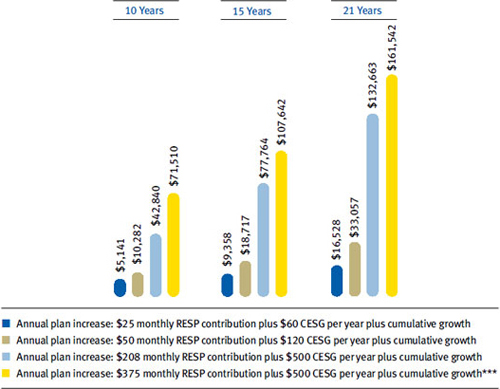

Royal Bank has a graphic that shows that you don’t have to put aside a huge amount of money to make a difference.

Even $25/week for 18 years can result in $50,000 waiting for a high school graduate. And if there aren’t 18 years left to save that amount of money, there’s still time to put away a little something to help make education that much more attainable (and to get some of that government money – why not take it?!?). Consider birthday money, or utilizing some of that “latte factor” money, to jump start an RESP.

RESPs aren’t just for the typical four-year university program, either. They can be used for technical programs, non-credit courses, an apprenticeship, or many other educational opportunities. And if the funds don’t get used, they can be rolled over into your RRSP.

To learn more about RESPs and how to start putting away a little bit of learnin’ money, check out RBC’s Education Savings Plan. It’s never to late to start saving!

24 comments

Marilyn

Planning for college is so important! This is a great post…..also, thinking outside the box and applying for scholarships help so much!

Tara

You’re so right, Marilyn! Applying for scholarships is a huge help! (And so few people do it, that sometimes the competition isn’t as fierce as you thought it would be!)

ChiWei

I remember thinking I’d go to McGill because it was only a few thousand a year to attend, and now college costs are just INSANE. Every little bit helps!

Tara

It IS daunting to think of saving up all of that money. But just like you said – every bit helps.

Adrianne at Happy Hour Projects

We have been saving, but our problem is: we haven’t been investing. I started an account for both kids the first month they were born. But with interest rates being totally abysmal, they are making very close to nothing. They might as well be in my mattress.

This is a really good reminder, thank you. Now that rates are doing better, I definitely need to re-visit our financial plan for our kids! As in – actually make a plan, and let that compound interest do a little something for them!!

Tara

You’re so right, Adrianne! It’s all about that compound interest in the long term. You sound like a savvy saver, lady!

Kadie

Oh my goodness!! College is something that has been on my mind a ton lately! My oldest is already 13 only 6 more years and he will be off to college. 🙁 I need to look over what interest our savings is making, thanks for the reminder!

Tara

Kadie – you have a 13 year old?!?! You look WAY too young! 🙂

Ephyna

Does your child have to go to school in Canada to take advantage of this program?

Tara

Hi Ephyna,

No, your child does not have to attend school in Canada; however, they do have to be a Canadian citizen in order to receive the Canadian Education Savings Grant.

If you live outside of Canada, there are most likely incentive programs in your state/country that can help you save for your child’s tuition.

Cynthia @ A Button Tufted Life…

I really wish we had this information when our son was young… I am very glad to see it here for anyone in this stage of planning… great post!

Tara

Thank you so much, Cynthia! I hope that other people read this and consider putting even a small amount away each month. It’s amazing how fast it piles up!

Patricia

You are a very wise Mommy and Daddy…. and your future ..whatever.. will thank you. I know this from experience… oh, yeah, it was with RBC too!!!

Tara

Patricia, I’m so happy to hear that your savings plan worked out well for you and YOUR “future whatevers”.

And “future whatevers” is dead on in this house. Today Lila announced that she was going to grow up to be a party planner. And Lucy? She said she wanted to be a person who lived in the dollhouse.:)

Dani @ lifeovereasy

Such important information! I just sent my oldest off to university, and I wish I had paid more attention to this kind of savings plan. (your girls are sooo cute!)

Tara

Awww. thanks, Dani! I think they’re pretty cute too!

And yeah, it is good information to get out there to Canadian families. There’s money to be had – might as well have it! 🙂

Inspire Me Heather

We are doing this too Tara, and started waayyy back before Kindergarten! Thanks for the information though, I’ll keep it in mind if I come across anyone that is thinking about starting a RESP.

Tara

Isn’t it amazing how quickly the funds grow?

Thanks for keep this post in mind! I appreciate it! 🙂

Debbie

We have been with the Royal Bank for years. They are so helpful and our banker looks after our investments like they are her own. We love what they do for us.

Debbie 🙂

Tara

Oh, I’m so glad to hear that, Debbie! I’m so glad that you’ve found a great advisor! 🙂

Kelly @ A Swell Place to Dwell

It’s amazing what a little money a month can do! It does really add up. And I was with you in that my family was able to pay for my eduction, and having the freedom to chose what I wanted to take without the added stress was such a huge gift.

Tara

It was a gift, wasn’t it? It’s amazing how I didn’t quite understand how lucky I was until I really started to understand budgeting and savings. And having seen the struggle that some of our friends have had with their student loans, I’m even more dedicated to ensuring that there’s a decent wad of cash there when the girls are ready to start school.

Laurie @ Vin’yet Etc.

My parents paid for my education, such a gift! This is so important, such a great reminder to parents!

Tara

Thank you, Laurie! I hope that if one parent sees that there’s some grant money to be had, that they’ll try to go for it. It’s amazing how free you are, being debt free at the end of your post-secondary career.